International Bitumen Market

Bitumen Market Analysis By Application (Roadways, Waterproofing, Adhesives, Insulation) And Segment Forecasts To 2024

Industry Insights

The global bitumen market size was USD 66.10 billion in 2015 and is expected to witness significant growth over the next eight years owing to increasing use in various applications including roadways, waterproofing, insulation, and adhesives. Rapid urbanization in emerging markets has contributed to rising in infrastructure activities. This has resulted in increasing demand for the product.

The asphalt (bitumen) binder is an essential element in various roadways applications on account of its higher strength, durability, and resilience. Concrete contains a small percentage of asphalt (bitumen) which is acting as a binder to enhance its resistance characteristics, which is expected to boost demand over the forecast period

Growing demand for infrastructure on account of growing the population, improving the standard of living is projected to bolster market growth over the forecast period. Increasing awareness about climate changes, along with global warming will drive roofing requirements which in turn is supposed to drive product demand over the next eight years.

Declining oil prices has resulted in tight raw material supply and caused price fluctuation and volatility in the market, which will restrain industry expansion over the forecast period. The long supply chain is a key feature owing to bitumen being a strong product to handle. This feature is being challenged as large contractors have begun directly selling to the refineries.

Application Insights

Roadways were the largest application segment in 2015, estimated at USD 39.29 billion. Road connectivity is the most crucial feature of any developed economy. This factor has resulted in market expansion on account of growing need for roads in emerging economies. The efficient transportation system in various countries including India, China, and the U.S. will stimulate product demand in the near future.

Rising demand for paving applications across different regions of the world especially in Asia Pacific and the Middle East will promote product growth over the next eight years. Growing modern construction systems having waterproofed flat roofs will stimulate bitumen demand over the forecast period.

Regional Insights

Asia Pacific was the dominant market in 2015 and accounted for over 33.0% of the global volume and will show growth on account of rising construction industry growth in India, China, Thailand, and Vietnam. Moreover, the presence of the major market players in the region including ExxonMobil, Shell Bitumen, and British Petroleum will augment industry expansion over the next eight years. Also, Asia Pacific will increase its bitumen consumption owing to the extensive road network in the region.

North America bitumen market was valued over USD 19.00 billion in 2015 and is expected to witness significant expansion on account of the growing need for rebuilding existing assets such as bridges, highways, and buildings.

MEA is expected to show significant volume gains with CAGR of 2.0% from 2016 to 2024 as a result of growing construction sector primarily in UAE and Qatar coupled with rising infrastructure activities in the region. Also, increasing government spending on construction will further propel industry growth in the near future.

Competitive Insights

The global bitumen industry is characterized by integration through raw material supply to the manufacturing stages. Companies including Valero Energy Corporation, NuStar Energy, Suncor Energy, Athabasca Oil Corporation, Imperial Oil Limited, Syncrude are engaged in producing crude bitumen from oil sands. Companies including Sinopec, Indian Oil Corporation, Nippon Oil Corporation, ExxonMobil, Shell Bitumen, Petróleos Mexicanos (PEMEX) Nynas AB, Marathon Oil Corporation captively consume crude bitumen, refine it and then use it in various applications.

Companies including Imperial Oil Limited, Valero Energy Corporation, Petróleos Mexicanos (PEMEX) and Shell are integrated across three stages of the value chain. Kraton Performance Polymers has developed a Highly Modified Asphalt Technology (HiMA) to cater to the ever-increasing demand from the paving and roofing sectors. This technology offers a broad range of modification options including styrene-isoprene-styrene, styrene-butadiene-styrene for high performance and superior quality.

Kraton Performance Polymer and British Petroleum are engaged in various grades of cost-effective waterproofing applications that provide with high water resistance and ability to withstand extreme temperatures. Cenovus Energy Inc. and Suncor Energy Inc. are some of the companies which have cut down their capital expenditures owing to the declining oil prices. The Canadian bitumen has a huge demand in the U.S. due to the presence of a vast number of processing units and refineries.

Bitumen Market Size By Product (Paving, Oxidized, Cutback, Emulsion, Polymer Modified), By Application (Roadways, Waterproofing, Adhesives, Insulation), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Spain, Italy, China, India, Japan, Australia, Indonesia, Malaysia, Brazil, Mexico, South Africa, GCC), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2016 – 2024

Bitumen Market size generated USD 75 billion in 2015 and is forecast to witness 4.2% CAGR by 2024.

Increasing government initiatives towards road development across the globe is analyzed to be the key factor propelling the global bitumen market size. The product is extensively used as a binder in the road construction. The U.S. road and highway construction sector generated revenue roughly around USD 100 billion in 2015 and will continue to grow at a steady rate till 2024. Furthermore, increasing global traffic in the emerging nations will require wider roads, which will consequently boost the bitumen market size substantially over the forecast timeframe. The product offers superior water resistance, high stickiness, and viscosity, which makes it desirable in the road construction applications.

The product is also used as an adhesive and sealant. It is also extensively used in the waterproofing of ships and boats owing to its water-insoluble characteristics. In the construction sector, it is used in manufacturing water tanks, dams and bridges. Robust growth in the construction industry on account of government initiatives to upgrade public infrastructure will positively influence the bitumen market size over the forecast timeframe. For instance, in 2013, the global construction spending was close to USD 7 trillion and is likely to touch USD 13 trillion over the projected period. Furthermore, it is also used in manufacturing battery, tire and for the thermal and acoustic insulation purposes. Growing paint & coatings sector on account of growing end-user industries including automotive is another factor driving the industry growth. Paints manufactured with the product provides superior corrosion and weatherproofing traits.

Stringent legislations by REACH regarding the product manufacturing and applications are likely to affect all the downstream producers as well as the end users. In addition, the product is derived from the fractional distillation of crude oil. Therefore, oscillating crude oil prices may negatively impact on the bitumen market price trend by 2024. However, development of bio-based bitumen will create new growth prospects for the industry participants.

Bitumen Market, By Product

Polymer modified bitumen (PMB) market share is forecast to witness highest gains over the projected timeframe. PMB is extensively used in road surfacing and industrial applications. The addition of polymers in the product upscale its viscosity and elasticity, which makes the resultant product much more suitable for applications with elevated stresses.

Paving bitumen market is forecast to witness gains more than 2.5% CAGR over the estimated period the product is majorly used in the road and highway construction. The segment is analyzed to witness escalating gains mainly due to rapid road maintenance and construction across the globe. The product is also used in the construction of railway beds, runways, bicycle paths, playgrounds, tennis courts, running tracks, barn floors and greenhouse floors.

Bitumen Market, By Application

Global bitumen market size for road construction dominated the global industry in 2015. Increasing population paired and upgraded living standards has significantly increased the global traffic across the globe, resulting in the construction of wider roads and flyovers. This trend is analyzed to boost the industry growth over the projected timeframe.

Bitumen market share for waterproofing applications was valued at over USD 9 billion in 2015. The product is widely used in waterproofing applications such roofing and piping. Superior water resistance characteristics of the product make it suitable to finds widespread applications across the construction industry, owing to boost the business growth by 2024.

Bitumen Market, By Region

North America dominated the global demand in 2015. Increasing government initiatives towards repair and redevelopment of the existing roads are the major factor stimulating the product demand in the region. Furthermore, increasing residential remodeling practices in the U.S. will subsequently boost the product demand for waterproofing applications over the forecast timeframe. Latin America and Middle East & Africa are forecast to experience promising gains by 2024 owing to increasing infrastructure development in the region.

Asia Pacific, mainly by China, India and Japan bitumen market size is forecast to experience gains close to 5% CAGR over the projected timeframe. Regional growth was mainly attributed by increasing construction spending in the region. With more number of cities coming up and rising consumer disposable income resulting in increasing number of private vehicles, the regional bitumen market share will experience escalating gains for road & highway construction by 2024. Furthermore, upcoming construction projects such as airports, in the region, will propel product demand for constructing runways.

Europe bitumen market size is slated to exceed 29-kilotons by 2024.

Competitive Market Share

Global bitumen market share was competitive in 2015. Key market competitors are British Petroleum, Total S.A., Chevron Texaco Corporation, China Petroleum and Chemical Corporation, Indian Oil Corporation, Royal Dutch Shell Plc., JX Nippon Oil & Energy Corporation, Petroleos Mexicanos, Bouygues S.A., NuStar Energy, Villas Austria GmbH, Marathon Oil Corporation, Exxon Mobil Corporation and Nynas AB.

Various companies including Petróleos Mexicanos (PEMEX), Valero Energy Corporation, and Shell have their presence across multiple levels of the industry ecosystem with enhances their global presence.

Bitumen Industry Background

The global bitumen market size is primarily driven by rising product application in road construction. The product is also used in paints & adhesives, which are extensively used in roofing applications. The roofing industry is one of the prominent growth drivers for the industry. Increasing temperature of the earth due to global warming will ultimately increase the rooftop insulation demand, which will subsequently boost the industry growth. However, fluctuating crude oil prices may obstruct business growth.

Bitumen Market worth over $110bn by 2024: Global Market Insights Inc.

“Global Bitumen Market Size By Product (Paving, Oxidized, Cutback, Emulsion, Polymer Modified), By Application (Roadways, Waterproofing, Adhesives, Insulation), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Spain, Italy, China, India, Japan, Australia, Indonesia, Malaysia, Brazil, Mexico, South Africa, GCC), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2016 – 2024”

Ocean View, Delaware, Jan. 11, 2017 (GLOBE NEWSWIRE) — Bitumen Market size is poised to exceed USD 110 billion by 2024 stimulated by increasing government initiatives towards repair and redevelopment of the existing roads; as per the latest research report by Global Market Insights, Inc.

The global bitumen market size is chiefly driven by increasing government spending towards road construction, maintenance, and repair. It is widely used as the binder in road constructions. In 2015, the U.S. road & highway construction business was valued at approximately USD 100 billion and is likely to grow significantly in coming years. In addition, growing roadway usage in cities and counties in Asia Pacific will pave the way for broader roads. High water resistance, viscosity, and stickiness, combined with a growing demand for widening roads and creating new roadways will help stimulate bitumen industry growth.

Highly water insolubility of bitumen enables it to be used as sealants and adhesives in marine applications for waterproofing applications. It is also used in water tank manufacturing to help preserve the precious commodity by curbing evaporation and leakage in storage. This demand in the construction industry was a major driving factor in the past and will be a strong driver in coming years.

Overall construction expenditure was valued at approximately USD 7 trillion in 2013 and is anticipated to mark USD 13 trillion by 2024 and is likely to help industry demand. The product is used in manufacturing tires, paints & coatings, batteries, insulation products and acoustic applications. Growing automotive industry will positively impact the global bitumen market.

Strict environmental regulations towards applications and manufacturing process threaten to impede growth in future years. For instance, the industry is firmly directed by occupational exposure limit. In China, Australia, France, and Belgium the limit is confined to 5 mg/m3. As the product is obtained from petrochemicals and crude oil, it follows the same price dynamics as crude oil and showed similar sluggish growth in the recent past. Wavering crude and petrochemical prices may impact the bitumen market price trends over the projected period. Nevertheless, the emergence of bio-based bitumen is analyzed to create new growth avenues for industry players.

Browse key industry insights spread across 125 pages with 153 market data tables & 12 figures & charts from the report, “Bitumen Market Size By Product (Paving, Oxidized, Cutback, Emulsion, Polymer Modified), By Application (Roadways, Waterproofing, Adhesives, Insulation), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Spain, Italy, China, India, Japan, Australia, Indonesia, Malaysia, Brazil, Mexico, South Africa, GCC), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2016 – 2024” in detail along with the table of contents:

Key insights from the report include:

- Bitumen market size will reach USD 110 billion by 2024, with projected growth at over 4%.

- Polymer modified bitumen industry size is expected to gain significantly over the next 8 years. It is widely used in industrial applications and road surfacing. Polymers are added to the product in order to enhance physical properties such as elasticity and viscosity, of the product making them desirable high-stress applications.

- Paving bitumen market share is shall witness gains at over 2.5% CAGR by 2024. The product segment shall witness promising gains mainly due to rapid road construction and maintenance globally. It is used in constructing runways, railway beds, playgrounds, tennis courts, running tracks, bicycle paths, greenhouse floors and barn floors.

- Growing population along with improved consumer lifestyles has substantially propelled vehicular traffic across the globe, resulting in rising demand for wider roads, which has enhanced demand.

- In 2015, the global bitumen market for waterproofing generated revenue more than USD 9 billion. Increasing waterproofing activities such as piping and roofing in the construction will drive business growth.

- In 2015, North America held the largest overall bitumen market share. Increasing road development and repair in the U.S. is the prime factor contributing the regional industry growth. In addition, rising residential renovation activities in the U.S. will consequently boost the industry growth in the region.

- Asia Pacific, led by China, is analyzed to observe growth at over 5% by 2024. Strong growth in the regional business is the crucial factor propelling regional growth.

- Key industry share contributors are Chevron Texaco, British Petroleum, Total S.A., Indian Oil Corporation, China Petroleum and Chemical Corporation, Shell., JX Nippon Oil & Energy, NuStar Energy, Petroleos Mexicanos, Villas Austria GmbH, Bouygues S.A, Marathon Oil, Exxon Mobil and Nynas AB.

Bitumen market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in kilo tons and revenue in USD million from 2013 to 2024, for the following segments:

Global Bitumen Market By Product

- Paving Bitumen

- Oxidized Bitumen

- Cutback Bitumen

- Bitumen Emulsion

- Polymer Modified Bitumen (PMB)

- Others

Global Bitumen Market By Application

- Roadways

- Waterproofing

- Adhesives

- Insulation

- Others

The above information has been provided for the following regions and countries:

- North America

U.S.

Canada

Europe - Germany

UK

France

Spain

Italy - Asia Pacific

China

India

Japan

Indonesia

Malaysia - Latin America

Brazil

Mexico - Middle East & Africa

South Africa

GCC

Asia/Pacific region will remain the largest market

Through 2019, global demand for asphalt is projected to expand 2.8 percent per year to 122.5 million metric tons (742.5 million barrels).

The Asia/Pacific region has overtaken North America as the largest regional market for asphalt and will continue to record the fastest advances through 2019, driven primarily by strong growth in China and India.

China surpassed the US as the leading global asphalt consumer in 2012 and accounted for over one-fifth of the global market in 2014. However, growth in China will decelerate from the rapid gains of the 2009-2014 period as the country shifts its focus to repairing and maintaining current roadways rather than expanding the road network.

Asphalt demand in India will benefit from the large public works projects necessary for the country’s continued economic development.

Global Modified Bitumen Market 2017-2021

This market research report identifies Colas, Nynas, Royal Dutch Shell, Sika, and Total as the key vendors in the global modified bitumen market. This report also presents a detailed analysis of the market by application (road construction and building construction) and by geography (the Americas, APAC, and EMEA).

Overview of the global modified bitumen market

Technavio’s market research report predicts that the global modified bitumen market will grow at a CAGR of above 6% during the forecast period. The Increase in building renovations and remodeling will be one of the primary drivers for the market’s growth. In addition to the demand for bitumen in road constructions, the market is also witnessing an increased demand for bitumen in building renovations and remodeling. With the rise in prices of houses increasing the global demand for repairing and remodeling houses, there will be a considerable increase in the demand for modified bitumen, especially for roofing applications. Additionally, the increase in employment rates in countries such as India and China will also drive the demand for modified bitumen.

One of the latest trends that will gain traction in the global modified bitumen market is the utilization of self-adhered products. Self-adhered modified bitumen pads have shown a lasting trend in the consumption pattern as an upgrade on roofing applications and is used for ice dam protection for shingle roofs. Self-adhered products offer benefits like the ease of installation, solution for fire resistance, and are used as base sheets and cap sheets for waterproofing membranes. Moreover, self-adhered modified bitumen membranes are also used to eliminate fumes during the construction of roofing applications and lower the odor emanating during the installation process.

Competitive analysis and key vendors

Vendors in the modified bitumen market focus on the manufacture of bitumen for various applications like paving, roofing, industrial applications, and waterproofing. To meet the specifications for asphalt production, the market players are increasingly concentrating on testing the nature, quality, and durability of the product. The market is subject to economic conditions in all countries, and the performance of the vendors is influenced by public funding patterns and the feasibility of operation.

Segmentation by application and analysis of the modified bitumen market

- Road construction

- Building construction

During 2016, the road construction segment dominated the modified bitumen market and is expected to continue its dominance over the next four years. The increase in road construction activities around the globe especially in countries such as India will be the major factor fueling the demand for modified bitumen in this market segment during the next four years.

Geographical segmentation and analysis of the modified bitumen market

- Americas

- APAC

- EMEA

In terms of geography, the Americas led the global modified bitumen market during 2016 and is foreseen to continue the domination during the forecast period. The increasing demand for rubberized polymers with asphalt will drives the market’s growth in this region. Moreover, the increased requirement for good-quality roads will also augment the markets’ growth prospects in the Americas.

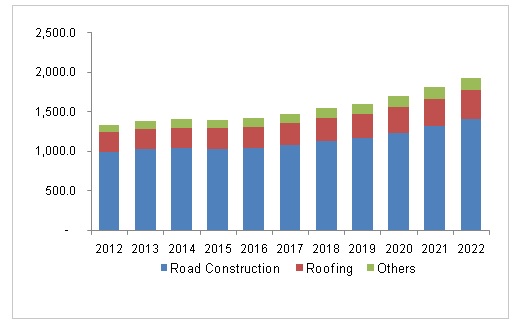

Polymer Modified Bitumen Market By Product (Thermoplastic Elastomers, Plastomers), By Application (Road Construction, Roofing) And Segment Forecasts To 2022

Global polymer modified bitumen (PMB) market size was estimated at USD 7.67 billion in 2014 and is expected to witness significant growth over the next seven years owing to its rising demand from various application industries including road construction, roofing, adhesives, and coatings.

Increasing focus on infrastructure development from emerging economies will propel industry expansion over the next seven years. Shifting preference from using conventional bitumen towards PMB for asphalt overlay owing to superior properties and lower maintenance cost is expected to fuel growth.

Changing climatic conditions and heavy traffic affects bitumen roads adversely, causing cracking and rutting. Every year, heavy investments are made as these roads need continuous maintenance. PMB requires substantial capital owing to high cost of the product. However, the product becomes cost-effective over a period of time owing to the reduced number of maintenance lifecycle.

Economies including India are expected to lead the PMB market owing to the increasing consumption of the product over the past few years for existing as well as new infrastructure. India had the second largest road network globally and the National Highways Authority of India (NHAI) has planned to acquire 10,000 hectares of land in 2015-16 to speed up road construction in the country connecting towns and cities.

TAPI Gas Pipeline, Turkmenistan; Myanmar Communications Network, Myanmar; KivuWatt, Rwanda; North-South Africa Corridor, Africa; Mombasa – Kigali Railway, Rwanda; Oyu Tolgoi Copper Ore Mine, Mongolia; and New Silk Road, Kazakhstan and are some of the key projects which are expected to augment the growth of PMBs.

Agreements & partnerships along with new product launches by key players is expected to stimulate market expansion in the near future. In addition, improved product quality offered by PMBs is expected to drive the industry. However, volatile raw material prices due to fluctuations in crude oil prices are expected to restrain growth over the next seven years.

U.S. polymer modified bitumen market revenue by application, 2012-2022, (USD Million)

Application Insights

Demand for polymer modified bitumen (PMB) was highest for road construction at 7,274.4 kilotons in 2014. Infrastructure development, particularly in emerging economies including China and India, is expected to drive demand.

The market is expected to witness rise owing to its usage in roofing applications at a CAGR of 7.0%, in terms of volume, from 2015 to 2022. PMB exhibits properties such as water repellency and flexibility which make them useful for waterproofing in roofing applications.

PMB membranes were initially used on low slope roofs and are now extensively being used in green roofs on commercial and residential buildings. Roofing market is anticipated to witness significant gains in the Asia Pacific owing to the expansion of the housing & commercial building sector over the projected period.

Product Insights

Thermoplastic elastomers were widely used a bitumen modifier accounting for over 60% of the volume share in 2014. Thermoplastic bitumen modifiers include ethylene-vinyl acetate (EVA), alpha-polyolefins (APO), atactic polypropylene (APP), and isotactic polypropylene (IPP). Styrene-butadiene-styrene (SBS) and styrene-butadiene rubber (SBR) are used as elastomeric materials. Improved aging resistance, low-temperature flexibility and resistance to permanent deformation by the addition of thermoplastic elastomers, particularly SBS, has resulted in driving growth.

Plastomers including polyolefins, ethyl vinyl acetate (EVA), high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE) are used in is also a key category of polymers used in polymer modification. Plastomers are expected to witness growth at a CAGR exceeding 6.0%, in terms of volume, from 2015 to 2022.

Regional Insights

North America polymer modified bitumen market accounted for over 35.0% of the global volume share in 2014. The rapid growth of the green roofing industry in the region is expected to play a critical role in the growth of the market. Moreover, growing demand for low smoke bitumen with improved resistance to climatic changes & UV is expected to drive demand for PMB over the forecast period.

Polymer modified membranes were first introduced in Europe in the 1960s, where they were used as two-ply application methods for roofing. However, in the past few years, the product is being extensively used for road construction. Demand for the product in road construction in Europe exceeded 1,820.0 kilotons in 2014. Infrastructure development in Europe is creating new opportunities for PMB.

Competitive Insights

The global polymer modified bitumen market is competitive with major companies involved in continuous product innovation and R&D activities. Key players include Total Oil India Pvt. Ltd., Benzene International Pte Ltd, Lagan Asphalt Group, Nynas AB, Royal Dutch Shell PLC, ExxonMobil, Gazprom NEFT and Sika AG.

The industry is characterized by contract agreements between raw material suppliers, manufacturers, and users, as companies are trying to expand their market share over the forecast period. For instance, Royal Dutch Shell PLC was awarded a contract to supply PMB for the construction of Muscat International Airport, which was concluded in 2014.

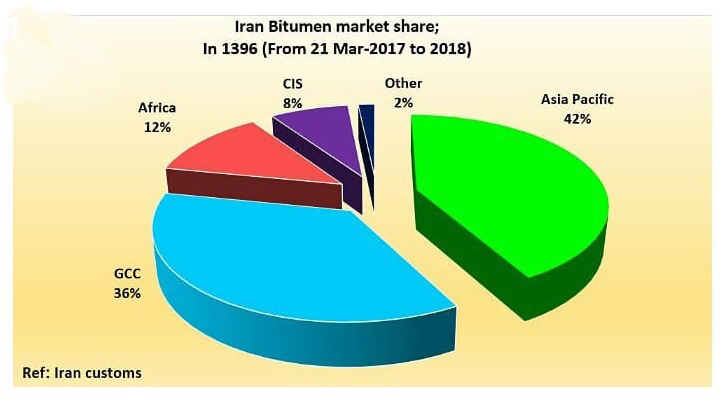

Iran Bitumen Market Share; In 1396 (From 21 Mar- 2017 to 2018)

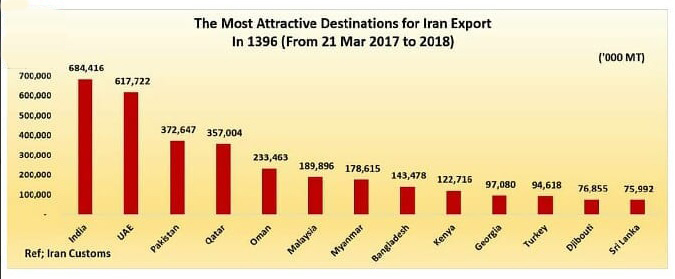

The Most Attractive Destinations Iran Export (In 1396 (From 21 March 2017 to 2018)

Comparison of Iran’s Bitumen Export in the Spring of 1396 and Spring of 1397