Indian Bitumen Market

An overview of the Indian Bitumen Market

India has the world’s second largest road network after the United States of America, with a road infrastructure of over 47,000 km.

The Indian bitumen market that is currently around 5 million tonnes is expected to grow in the future due to the Governments proposed construction projects to upgrade the road network.

Bitumen is used as a binder in road construction and in roofing and waterproofing applications. Almost 90% of the bitumen is used in India is in road construction with the balance of 10% shared equally for roofing and waterproofing.

Nearly 90% of this demand is provided from domestic production of bitumen, whilst the remaining 10% is imported, mainly from the UAE and Iran.

The bitumen currently used in India are either penetration grades or the currently preferred viscosity grades.

Bitumen handling in India is still mostly done by using traditional methods, which includes heating of bitumen drums on-site in the open. Recently the Government has issued instructions and regulations to provide application methods of bitumen and solutions to eliminate environmental problems in the handling of bitumen.

Bitumen packaging and transportation in India is mainly provided in bulk, or in drums. Other innovative packaging types like polybags are available, but problematic due to the hot climate in India, which causes bitumen to melt in the bags.

India’s massive demand for bitumen

India to lead the pack in bitumen consumption – Partha Pratim Basistha reports from the Asian Bitumen Conference In the emerging global bitumen market, demand is expected to reach 122 million tonnes by 2018. Increasing road construction activities in the fast-growing markets of India and China will be the main growth drivers of the bitumen market in Asia. This was the message delivered at the 10th Asian Bitumen Conference held in New Delhi, India from 23rd-24th November 2015.

The two-day event, organized by Conference Connection and supported by the Indian Ministry of Petroleum & Natural Gas attracted strong participation from Indian road contractors, bitumen producers, traders and key bitumen industry experts and speakers from India, US, Iran, UAE, Sri Lanka and Indonesia. The speakers discussed in detail the latest market trends and technical developments in the bitumen industry and offered insights about the new challenges and opportunities offered by India and other emerging Asian bitumen markets.

Delivering the inaugural address, Dharmendra Pradhan, the Indian Minister of State, Ministry of Petroleum & Natural Gas said, “India commands a road infrastructure of 3.3 million km, the second largest road network in the world, after the USA. Out of the total network, India’s National Highway network comprises 100,000km of State highways, while village and district roads occupy 2.8 million km. The National Highways cover 2% of the total network and carry the maximum share of freight and passenger traffic making them India’s lifeline. The government has kept the development of roads at a high priority, allocating more than 10% of total spending from 2012-17 to the road sector. The investments would be for setting up new networks and rehabilitating existing road networks. In such a scenario, bitumen will play a vital role towards planning and execution of road construction projects in India. Based on the projected demand from upcoming projects, India’s bitumen consumption will outpace production in the coming years.”

He said, “It is commendable, that to ensure longevity to road projects, Indian refiners have begun producing viscosity grade, polymer modified bitumen, emulsifiers and other value-added bitumen.” However, the minister insisted, “Owing to diverse climatic conditions, it requires the better understanding of bitumen supply and demand in the country by the Indian and foreign refiners and traders.”

In his welcome address, CEO, Hotcrete Infrastructure India Pvt, Ravikanth Reddy said, “During 2014–2015, total bitumen sales in India were 4.8 million tonnes. Based on the ambitious road development plan of the government, there will be an increase in demand of bitumen in India. Presently, 90% of India’s road requirement of bitumen is met by the local oil refiners while the rest is imported.”

Speaking at the conference, RK Pandey, Member Projects, National Highway Authority of India (NHAI) said, “There are colossal business opportunities for bitumen producers and suppliers in India, based on numerous road development projects being undertaken by NHAI under the prestigious National Highway Development Programme (NHDP) to strengthen India’s existing National Highway network handling the fast-growing traffic on its two-lane and six-lane express ways.

Sharing details, he said, “Projects are being undertaken in seven phases by the NHDP. This involves the development of the ‘Golden Quadrilateral Link’, connecting India’s four metropolitan cities: Mumbai, Delhi, Kolkata and Chennai, and involving a network of 7,000km. The second phase involving a network of 5,500km will connect the east and west and north and south of the country. Projects in the third, fourth, fifth and sixth phases will involve strengthening the feeder network connecting the GQ. Key projects include six-laning of the Golden Quadrilateral network, setting up of expressways on Delhi-Agra route, Delhi-Chandigarh in North India, Ahmedabad-Vadodara, Vadodara-Mumbai in Western India, and Bengaluru-Chennai in Southern India. Phase seven involves the construction of flyovers, expressways. Further, under NHDP, there is the ‘Special Road Development Project’ for the North Eastern States of India and development of National Highways on India’s international boundaries, and road connectivity improvement initiatives to India’s non-major ports.”

Pandey insisted, “Since most of the newer Indian road projects are being developed on the ‘built operate and transfer’ contract model, the bitumen supplied should be of desired quality and have to deliver total lifecycle costs. This has been found short on many occasions.”

Making a presentation on the outlook of the Indian bitumen market, RS Sisodia, general manager (consumer sales), Indian Oil Corporation, the state-owned oil refiner said, “Demand for bitumen in India is determined by budget allocation, duration of financial closure of projects and the release of funds. State government road projects contribute 55% of bitumen demand. The NHDP based on World Bank and Asian Development Bank financing contributes 40% of demand and central and industrial sectors contribute 3% of demand. Based on newer requirements for road projects with longer maintenance schedules, IOCL has upgraded its refineries to produce viscosity grade bitumen made through its six refineries.”

He said, “Viscosity 10 grade bitumen comprises 35% of demand in India, VG 30 comprises 60% of demand and VG 40 comprises 5% of demand. Based on duration and size of road projects taking place in India, there is a variation in demand across regions in bulk and in drums. However, with bigger road project packages being awarded in Western and Northern Region, demand for bitumen has gone up in bulk to 87. 2% in 2014-15, up from 81.4% during 2006-07 in the region.”

Bitumen imports India jump as highway expansion drive picks up pace

India’s roads and highways expansion drive has led to a sharp annual growth in import of bitumen, a refinery by-product used in laying the surface of roads and highways, opening up a growing market for shipments from Iran, the UAE, Malaysia, Singapore, and Greece. Indian refiners, in the meantime, are focusing on capturing the global market for high-end finished petroleum products.

While India’s refining capacity rose by 21% since 2010-11 to 234 million in 2017-18, bitumen imports rose by a phenomenal 823% during the period to 905,000 tonnes as demand outpaced production and refineries opted for maximising output of other high-revenue-yielding finished petroleum products such as petrol, diesel and jet fuel with an eye on export markets, data from oil ministry’s arm Petroleum Planning and Analysis Cell showed.

Imports from Malaysia and Singapore rose sharply in the April-February period of 2016-17 from a year ago in rupee terms, showed data from the commerce ministry.

The pace of road construction has picked up in the last few years. During 2012-14, highway construction was around 9km a day, which rose to 17.2km a day in 2015-16 and to approximately 22km a day in 2016-17.

A record 47,350km of roads were constructed during 2016-17, the highest-ever in the last seven years, under the Pradhan Mantri Gramin Sadak Yojana (PMGSY). This contrasts with 25,316km of roads built in 2013-14, 36,337km in 2014-15 and 36,449km in 2015-16.

Experts said the trend of rising import of bitumen will get more pronounced in the coming years as the country makes more rural roads to improve connectivity.

Binaifer F. Jehani, director, industry and customised research, CRISIL Research, said the demand for bitumen is expected to grow at a compounded annual growth rate (CAGR) of 5.6% to 8 million tonnes in 2020-21 due to a 6-7% CAGR in lane kilometers, largely driven by the expansion in rural roads. “Imports are also expected to increase due to strong growth in bitumen demand but the major part of it will continue to be supplied by domestic refineries,” said Jehani.

An official from the National Highways Authority of India (NHAI) said, on the condition of anonymity, that import dependence will expose states, which rely on bitumen for laying roads, to price and currency volatility, while the Central government is making a transition from bitumen to cement and concrete for laying national highways. “Most of the road estimates being prepared for NHAI are now based on cement and concrete, which costs roughly around 10-20% more,” said the official.

Refineries in the country, in the meantime, are eying the higher end of value-added refinery products with the hope of becoming major regional suppliers. “Bitumen is said to be at the bottom of the barrel, which implies its position among the set of refinery products. It, therefore, makes sense for refineries to maximise production of higher-end items such as petrol and diesel, that could fetch them better margins. Production of bitumen also depends on the kind of crude used,” said R.S. Butola, former chairman of Indian Oil Corp., the largest refiner in the country. That approach has resulted in Indian companies exporting 15.4 million tonnes of petrol and 27 million tonnes of diesel in 2016-17, showing a growth of 14% and 34%, respectively, from 2010-11 levels.

India, one of the country’s largest consumer of bitumen in the world

India’s annual volume of bitumen required of the country of Iran. The best example of bitumen produced in Iran with special barrels to the country of India. The maximum size of the bitumen supply bitumen 60/70 countries India, bitumen 85/100. Types of bitumen for road construction in India. Very high-quality bitumen to India each year, causing about their need to buy from Iran. In this way the manufacturers’ bitumen one of the largest suppliers of this product to India. In Iran, the world’s largest manufacturers and suppliers have been able to bitumen a very good performance for customers in India to go along.

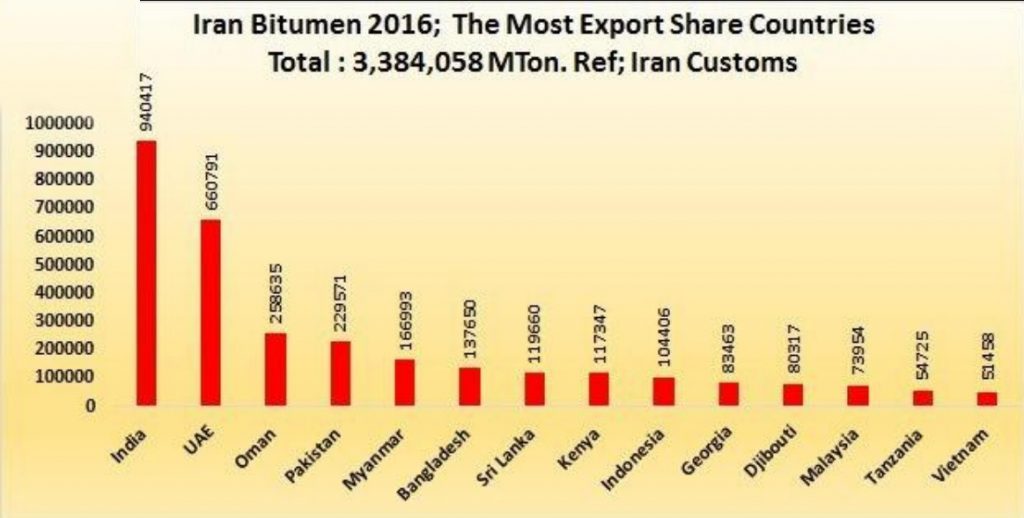

Iran Bitumen Export Share Market 2016

The Asia Pacific with 50% Export Share, is Biggest Market of Iran

The Most Iran Export Share Countries 2016

India Is Always The major Market Of Iran Bitumen.

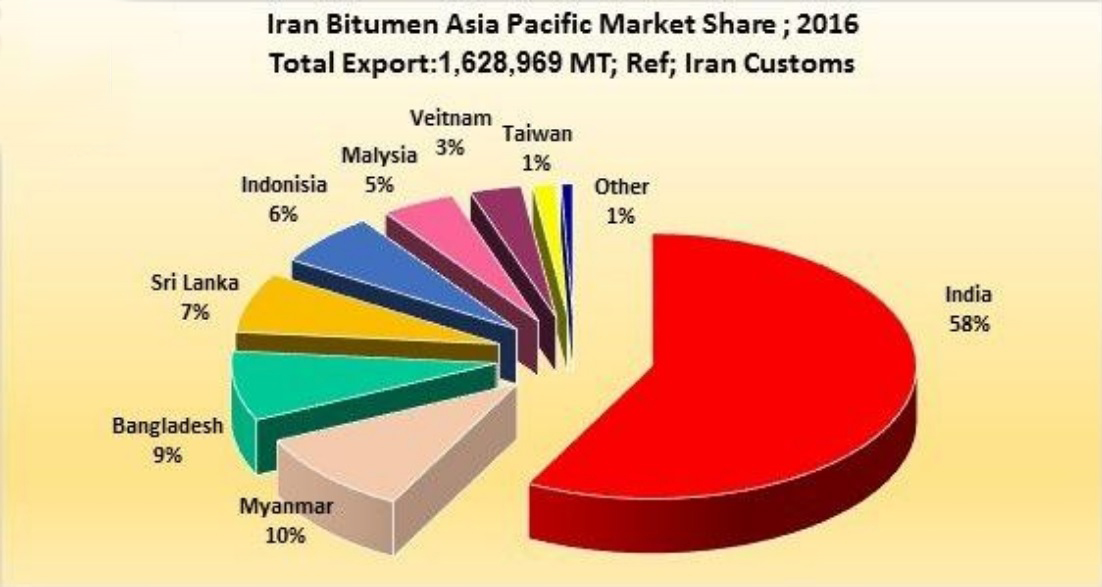

Iran Bitumen Asia Pacific Market Share;2016

Total Export : 1,628,969MT; Ref; Iran Customs

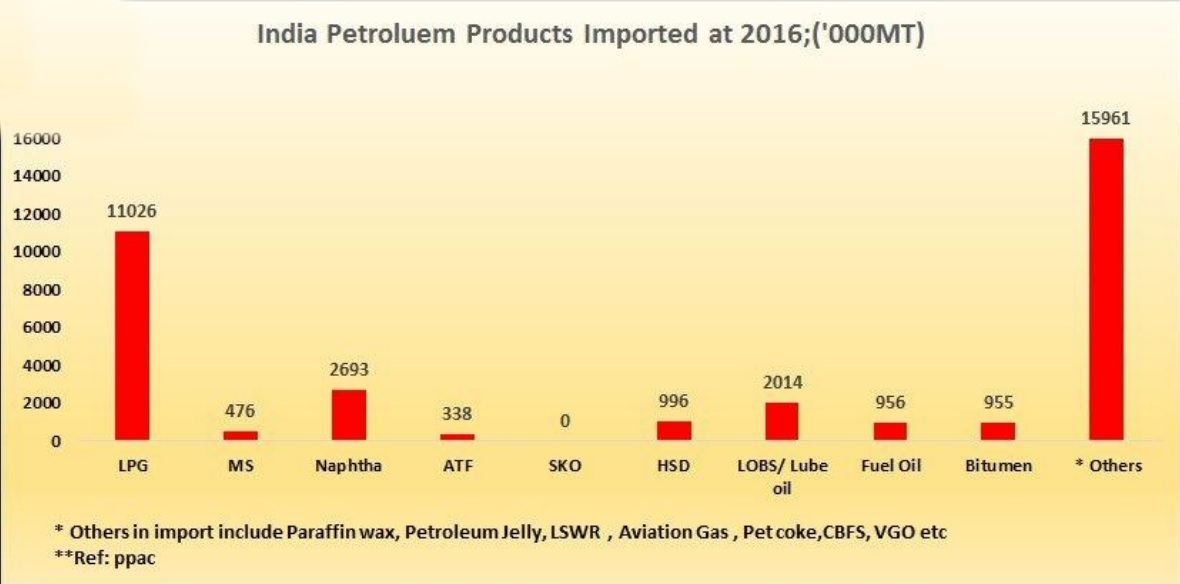

India Petroleum Products Import at 2016

At 2016; Bitumen accompanying with Fuel oil has third ranking of imported Petroleum Products to India.

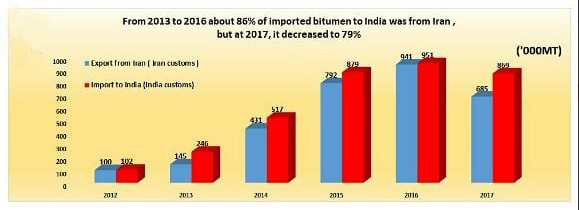

Bitumen Import to India vs Export from Iran

During 5 Years; 86% of imported bitumen to India was from Iran

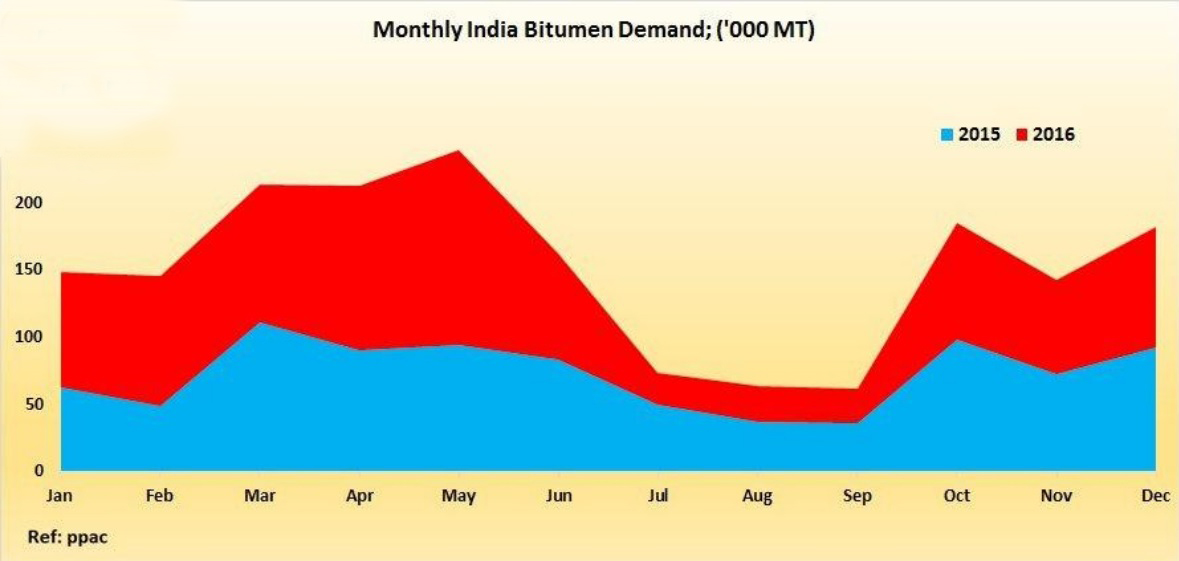

Monthly India Bitumen Demand

During 2015-2017

From 2013 to 2016, about 86% of imported Bitumen to India was from Iran; But at 2017 it decreased to 79%.

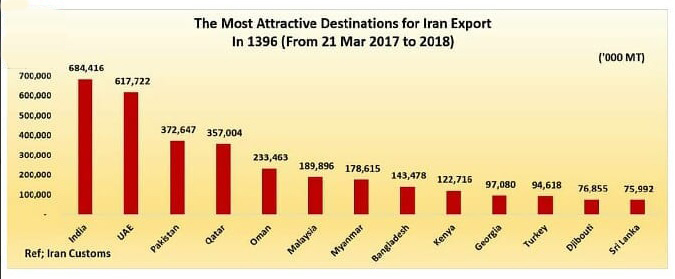

The Most Attractive Destinations Iran Export (In 1396 (From 21 March 2017 to 2018)