Waterproofing Membranes Market

Waterproofing Membranes Market Size By Application (Sheet Membranes, Liquid Applied Membranes), By End-Use (Building Structures, Roofing, Walls, Landfills & Tunnels), By Product (Polymers, Polymer Modified Cement, Bitumen, Others), Regional Outlook (U.S., Canada, Mexico, Germany, UK, France, Italy, Russia, Spain, Austria, Luxembourg, Belgium, Netherlands, Czech Republic, Poland, China, India, Japan, Indonesia, Malaysia, Thailand, Australia, South Korea, Brazil, Saudi Arabia, South Africa), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2016 – 2024

Industry Trends

Waterproofing Membranes Market size was worth above USD 5.6 billion in 2015, with gains expected at around 7%

Positive outlook towards increasing durable building materials usage in construction applications should drive waterproofing membranes market size. The global construction industry was valued at around USD 7.2 trillion in 2015. Construction spending in China and India surpass USD 1.5 trillion and 4 billion respectively in 2015.

The government initiative to boost construction development in China, India, Indonesia, Malaysia, Japan, and Thailand should positively influence product demand. The 12th Five Year Plan of China announced to construct 56 airports and expand 16 airports with a total investment of over USD 65 billion, should favor waterproofing membranes market growth. Also, UK, Germany, France, U.S., China, and India have encouraged activities for land filling and clean groundwater, which would support industry growth.

These products form an important element to control liquid penetration by covering the surfaces and forming resistant characteristics. Ample availability of raw materials and key properties which include liquid adsorption quality, flexibility and UV resistance features should drive waterproofing membranes market size.

Waterproofing membranes are applied over wet surfaces and waste management industry. Increasing urbanization and tendency to shift industry base in APAC would drive the outlay and produce waste. In 2015, waste management market was worth over USD 400 billion and may be worth around USD 550 billion at the end of 2024.

PU liquid membranes find extensive usage in roofing applications. Material growth may be excessively high owing to its durability, versatility, excellent strength/weight ratio and insulation. Inferior construction quality material and poor building maintenance should provide the opportunity for rehabilitation and repair, which would boost liquid PU waterproofing membranes market size.

Key feedstocks for manufacturing these products include polypropylene and bitumen. These materials are petroleum based and variations of crude oil index may hamper production costs and affect waterproofing membranes market price trend.

Waterproofing Membranes Market, By Application

Liquid applied waterproofing membranes market size should register over USD 7.5 billion by 2024. It is cost-effective and provides strength, durability, and elongation against harsh weather climate and is best suited for roofing.

Preformed sheet waterproofing membrane applications should grow at over 6%. It has advantages including low maintenance & cost and safety characteristics. Sheets can cover openings and link over cracks with higher success than liquid applied membranes. These sheets are used in balconies, bathrooms, roofs, and walls.

Waterproofing Membranes Market, By Product

The polymer waterproofing membranes market size was worth over USD 2.5 billion in 2015. Polymers include TPO, PU, PVC, and EPDM are main constituents used in product making. These deliver a monolithic application with no layers, leaving no drawback for cracks to develop.

Bitumen waterproofing membranes market size should witness at over USD 4 billion by 2024. It is a petroleum-based product and is manufactured in two grades, APP butadiene, and SBS bitumen. Bitumen is restricted in the U.S. owing to concerns regarding the environment. But, in China and India, use of bitumen is presently owing to relaxed government norms.

Polymer modified cement membranes have good resistance against sunlight penetration and are made in light shades to lower building structure cooling costs. They are mainly used in bridges, subway system, effluent treatment plants, railways, parking structures, tunnels, marine docks, ports, and dams.

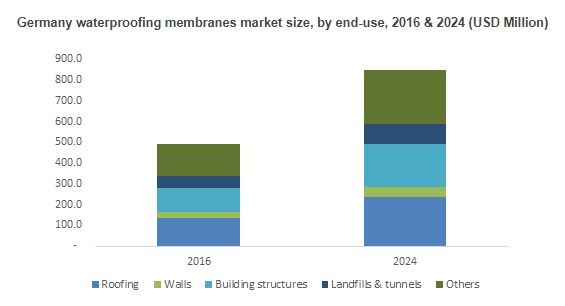

Waterproofing Membranes Market, By End-Use

Waterproofing membranes market size from roofing applications should generate over USD 3 billion by 2024. These products protect from high temperature and have the capacity to withhold the weight exerted by pedestrian traffic. Generally, preformed sheet membranes are used, whereas in some cases liquid films are also preferred. Liquid membranes are mostly applied on walls to maintain aesthetic characteristics and reduce cost.

Waterproofing membranes market size from buildings structure applications was above USD 1.25 billion in 2015 with a growth rate exceeding 7.5%. The material protects from harsh weather conditions and increasing longevity of buildings. Waterproofing sheets are mainly used on kitchen and bathroom floors, wet rooms and roofs to diminish the chance of prevailing accidents. Liquid-based products are also used as a protective coating over the primary paint coat.

Waterproofing Membranes Market, By Region

U.S. waterproofing membranes market size should witness growth at around 5.5%. EPA recognized PFOS and PFOA as hazardous materials forcing the manufacturers to exclude fluorocarbons. This norm led to new strategies to be undertaken by manufacturers to increase biopolymer products production by different companies in myriad applications.

Europe waterproofing membranes market size may foresee over USD 3.5 billion revenue by 2024. European Association declared favorable prices to produce polymer products derived from biomass, thus resulting the market players to provide environment-friendly approaches.

China waterproofing membranes market attain installations over 150 mn sqr. mtrs in 2015. Infrastructural development and increasing industrialization has led the regional industry growth. Also, mining activities also fuel regional industry.

Competitive Market Share

Global waterproofing membranes market share is moderately consolidated. Some companies operating in this industry are Dow Chemical, BASF, Silk AG, Du Pont, Covestro, Pidilite, Fosroc, CICO Technologies, W.R. Meadows, Soprema Group, Johns Manville, Synergies, Cangzhou Jiansheng Building Waterproof Material and Fairmate Chemicals. Companies including BASF, Pidilite, and Dow are present across the value chain and captively use raw ingredients for producing different product grade.

Key market players emphasize on mergers & acquisitions and product innovation. In September 2016, BASF announced the acquisition of Henkel’s Western European tiling, flooring and waterproofing business to strengthen its product portfolio in Construction Chemicals. Also in January 2016, GAF acquired Icopal from Investcorp Ltd for approximately USD 1 billion to expand its product portfolio and make a stronger base in the European market. In July 2013, Sika acquired JM Texsa and Texsa India, both are manufacturers of waterproofing membranes.

Companies undertake technological innovations for new product development which should drive waterproofing membranes market size. Pidilite recently introduced a new LEC product, an advanced insulation solution provider with the key target to provide environment-friendly answers for numerous applications.

Waterproofing Membranes Industry Background

Waterproofing membranes are used mainly to prevent liquid penetration and protect the surface from harsh climate conditions. They can be used either in sheets or in liquid form as coating application. Sheets are generally preferred over flat surfaces whereas, liquid applied membranes are used in case of vertical or slope surfaces. There are several companies manufacturing waterproofing membranes under different brand-names including USG Durock, Renolit, and Ardex. Chemical composition varies with the products on which it is applied.

The major companies are making technological inventions for the new product, which is a key factor for market growth over the forecast period. In 2015, the Pidilite company launched an innovative environment-friendly Low Energy Consumption (LEC) product which provides both insulation and waterproofing solution for several applications.

Bitumen Membrane Market to reach USD 3.5 billion by 2025

Global Bitumen Membrane Market is set to grow from its current market value of more than $2.5 billion to over $3.5 billion by 2025; according to a new research report by Global Market Insights, Inc.

Bitumen membranes have been widely utilized in the construction sector due to their superior properties of rust proofing & waterproofing. These products provide protection to the concrete structures against moisture and increase its durability. Rising construction activities in major countries including China, Japan, the United States, India, etc. are likely to drive the product demand in the next few years. Government initiatives to build infrastructure in the emerging nations will further propel the product demand in the near future. For instance, Government of India have initiated AMRUT and smart city projects in major cities in order to improve the rural and urban infrastructure and living standards. Additionally, many upcoming construction projects in UAE and China will propel the bitumen membranes industry growth by 2025.

Another key growth enabling factor is the growing automotive industry across the world. The product is utilized in the coating applications of automotive components such as cap sheets. Increasing vehicle production in major parts of the world along with the rising personal car market demand will drive bitumen membranes industry demand by 2025.

According to grade, the market can be classified into SBS (styrene butadiene styrene) and APP (atactic polypropylene). SBS grade is likely to grow at a CAGR of around 5.5% in the study period due to rising product demand in the construction industry. Superior product features including dimensional stability, excellent strength and better elongation properties will drive its demand in the industry by 2025.

On the basis of product, the market is segregated into liquids and sheets. The key properties of liquid bitumen membranes including excellent waterproofing characteristics, high compatibility in wet substrates, superior performance in varying temperature condition, etc. is likely to drive the industry growth in the near future.

On the basis of application, the industry is segregated into automotive, non-residential, residential and other applications. Non-residential segment is likely to have substantial product demand due to rising product usage in the commercial buildings including, office buildings, malls, hospitals, educational institutes, etc. Superior waterproofing nature of the bitumen membranes is responsible for its growing usage in the non-residential segment.

Europe is a leading region which will hold around 35% share of bitumen membranes market over the study period. This is due to a mature automobile and construction sectors in Europe. Asia Pacific will also be a key region in the bitumen membranes industry due to growth of automotive industry in the emerging countries. The key factors such as increasing income, rising urbanization, etc. will propel product demand by 2025.